How To Build A Property Portfolio That Is Truly Diversified

How To Build A Truly Diversified (And Bulletproof) Property Portfolio

A friend who recently took his first plunge into non-U.S. real estate investing told some of his friends about the opportunity he was buying into.

What he’s buying into is an agricultural project in Panama that I’ve been telling you about for the past 20 months.

I should have prepared the guy for the reaction he’d get if he mentioned his plans to his country club buddies (as he did). Their responses ranged from swift dismissal of the idea to outright horror that he’d invest in something non-American.

The problem, I believe, is a fundamental ignorance among most Americans of anything beyond U.S. markets. Most U.S. investors buy into mainstream financial institutions’ propaganda to do with asset diversification. The SEC’s page explaining asset allocation for beginner investors makes my point. That page talks about stocks, bonds, and cash, with mutual funds as a subset of stocks. Include some of each of those asset classes in your portfolio, and you’re well diversified from the SEC’s point of view.

Real estate isn’t even included in the conversation. That’s because the financial industry doesn’t want investors thinking about anything other than stocks, bonds, and mutual funds. They make money when you buy those products from them; they make nothing when you buy a condo, a beach house, or a finca. So they work at every opportunity to brainwash the public into believing mainstream financial products are their only viable investment options.

The U.S. real estate investment industry helps to counter that position; however, most U.S. real estate investment gurus preach building a portfolio of no-money-down leveraged rental properties. That’s a strategy for getting started in real estate investing if you don’t have any capital (it is, in fact, how I got started, more than 20 years ago, in Chicago), but it’s limited. It results in a narrow portfolio (rental properties only) that, critically, is U.S.-centric.

The Path To True, Total Diversification

Knowingly and intentionally taking a position that runs contrary to the U.S. mainstream, my friend has opened up his investor’s mind to a broader definition of diversification as he pushes ahead to build his retirement portfolio. He’s keen to identify cash flow opportunities that can achieve better than the 3% yield he’s looking at, on average, from his stock portfolio. Taking stock, he’s realized that the big investment winners he’s had over the years have been few and far between… and generally have been made contrary to his investment advisor’s recommendations.

This realization led him to looking at real estate overseas.

My friend owns real estate in the United States. He isn’t planning to sell it, and I wouldn’t recommend that either. The objective is true and total diversification. Moving all your investments outside the United States cuts out a potentially interesting diversification option. When one market is down, others are up. You want to spread yourself around among as many different markets (different for their economies, their politics, their demographics, their currencies, etc.) as possible… including, often, the United States.

As you work to build your own retirement portfolio, you want as many options for cash flow as your investment budget will support. When some are having off years, others could be exceeding expectations. At least that’s the theory.

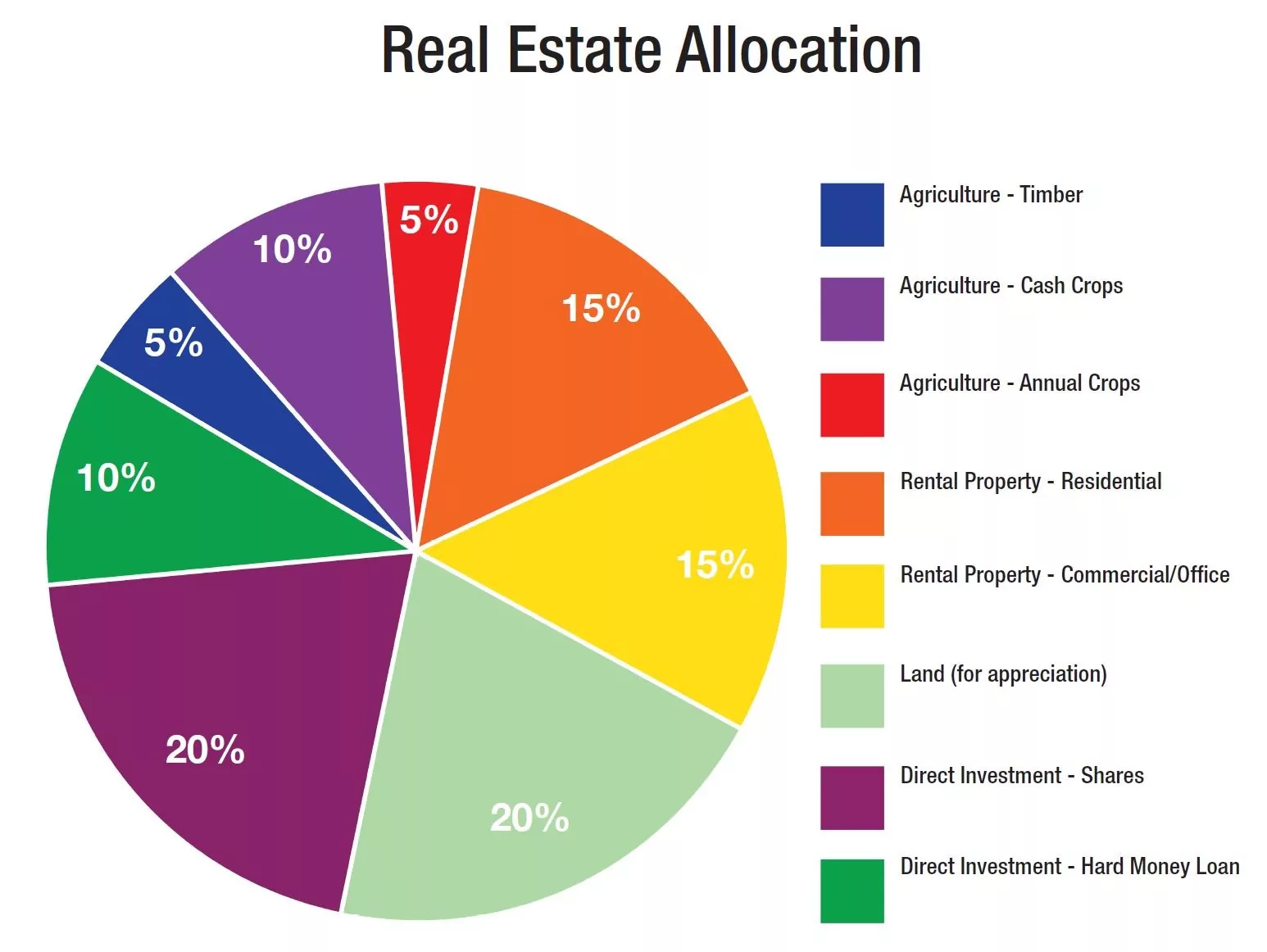

Here, for reference, is my own retirement portfolio diversification plan:

|

Fortunately, my friend is ignoring his naysaying friends. He’s actively looking for a next non-U.S. property investment. I’m doing what I can to help.

Lief Simon

Mailbag

“Lief, Argentina defaulted in 2001 under Hector Kirschner, the late husband of Cristina Fernandez de Kirschner, so you are blaming the widow for her dead husband’s default.

“My wife and I were there to look for bargains and bought not real estate but bonds guaranteed by the Spanish Telefonica firm, on which we made money like banditi…”

P.L.

Didn’t mean to blame Cristina for the 2001 default. I simply meant to reference that as the starting point of the last opportunity to buy in Argentina.

Thanks for taking time to write in.