The Foreign Bank Account Report (FBAR)

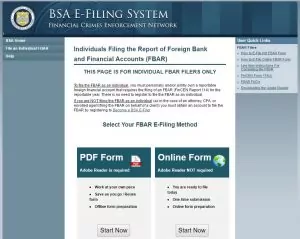

The first and perhaps most straightforward step anyone could take toward internationalizing and diversifying their life would be to open a bank account in another country. In this case, your U.S. filing obligation comes down to the FBAR, which is officially FinCEN Form 114. This form must be filed electronically through the U.S. Dept of Treasury (http://bsaefiling.fincen.treas.gov/NoRegFBARFiler.html).

The threshold for whether an American must file this form is US$10,000 or more in one or more financial account(s) at any time during the calendar year. The “at any time” part can catch some people unawares.

For example, if you open a bank account in Belize to buy a piece of property and send US$100,000 to the account for the purchase, you meet the requirements for filing the FBAR even if that money is in the account for a single day.

Thankfully, the threshold is an annual test. Using the same example, if you open an account in Belize to buy a piece of property in 2016 and transfer US$100,000 for the purchase, you must file the FinCEN. However, if then in 2017 you use the account only for paying local bills and the account never contains US$10,000, you don’t have to file in 2017.

The US$10,000 threshold is for aggregate balances at any time during the year. One account with US$10,000 in it meets the requirement, as do 10 accounts containing US$1,000 apiece on a single day. The number of accounts isn’t the trigger, and neither is the amount in any one account. It’s the highest aggregate value on any given day.

Note that the FBAR isn’t an IRS form; it’s a Treasury Department form.

In 2016, the filing date changed from June 30, 2016 (for 2015 taxes) to April 15, 2017 for the 2016 calendar year to coincide with the due date for your regular tax return.

Information Required For The FBAR

The information required for the FBAR includes:

- the bank name

- address

- account number

- the highest balance in the account during the year

This information is required for all accounts that you have a financial interest in. You also have to report accounts you have signing authority for but no financial interest in, unless that account is reported by someone else on your behalf. Certain exceptions can be found on the IRS’ FBAR guidance page.

The signatory thing can cause problems. Most people aren’t aware of this point. It means that, if you’re an expat working for a company in some foreign land and you have signatory authority over the company’s local bank account, you have to report the account if the company isn’t reporting it.

You can save time if you have 25 or more offshore accounts to report. In that case, you don’t have to complete the account details on the form. You just check the box indicating that you have more than 25 accounts. You’re still required to maintain the information that would have been included on the form had you filled it out in full, but, for some reason that no one seems to understand, if you exceed the magic number 25, you don’t have to provide individual account data on the FBAR.

Note that, even if you don’t meet the requirements for filing the FBAR, you still have a filing requirement if you hold any bank account offshore. In that case, you must tick a box on Schedule B of the 1040 Form. Many people don’t realize this, and it is one easy way for the IRS to get you for noncompliance.