A Few Reasons To Live And Invest In Colombia Today

Two Reasons You Should Meet Me In Medellín In April

The window to take action in Colombia is right now… for two reasons:

First, current exchange rates have pushed down property prices in Colombia to levels not seen for many years. Not surprisingly, real estate sales to Americans are at an all-time high.

The U.S. dollar continues its rampage against the Colombian peso. How much stronger will the dollar become versus the peso? No one can say, but here’s what I can tell you: Waiting to find out could mean you miss out on an opportunity of your lifetime.

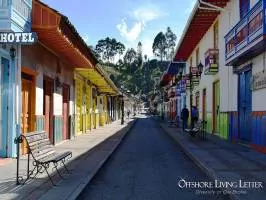

The second reason this upcoming event is important has to do with the mainstream attention Colombia is receiving. For years, buyers and investors in Colombia have benefitted from the country’s lingering stereotypes of powerful cartels and drug lords. Because of this negative reputation, property prices in beautiful, First World Colombian cities such as Medellín have far under-represented property values on the world market.

However, earlier this year, The New York Times listed Medellín among their Places to Go for 2015 (for the second time), and National Geographic Traveler included the country on their Best Trips for 2015 list. That’s about as good as it gets when it comes to mainstream coverage.

When we first recommended Medellín almost eight years ago, we were part of the fringe… we got hate mail for even suggesting readers consider investing time or money anywhere in Colombia.

Today, with recommendations from The New York Times and National Geographic Traveler, a new crowd is paying attention. Instead of just the fringe players and adventurers, we’re starting to see Aunt Mabel showing up because she likes Medellín better than Scottsdale, Arizona, or Naples, Florida.

This is fine of course… but it means that the fringe pricing is on its way out.

If you’ve ever considered a move to or an investment in Colombia, then I say again that now is the time to act. When it comes to mainstream acceptance, there’s no putting the genie back in the bottle. As more people discover what Colombia has to offer, the secret will be out for good.

Lee Harrison

“Lief, maybe you and your experts have a conflict of interest and just talk about currency advantage when it’s relevant to your own developments or developments where you get a larger commission?

“The U.S. dollar could run further. ECB today is to announce their increased money printing, so euro will go lower. Also, China’s empty real estate, bridges built but going nowhere, and slowdown in manufacturing signal that CNY is overvalued.

“OK, so what about Africa where currencies have dropped in many countries? Or Kazakhstan, which dropped from 0+/- to 300 +/- in 1.5 years? And many other countries’ currencies have dropped. Why all the fuss about South and Central America countries? Of course geographically close to southern USA, but northern USA is maybe same distance to South America or Europe.

“And why not also parts of Asia?”

Anonymous

A country’s currency becoming weak against the U.S. dollar doesn’t necessarily mean that real estate in that country is a good investment.

“Lief, I’ve just signed up for your event in Colombia in April, and I have a question: In Medellín when buying property, do they do owner financing or is it all bank financing? If so, what is the percentage for a typical down payment?

“Thanks. Look forward to attending.”

R.T.

As a foreigner, you won’t be able to get bank financing for the purchase of real estate in Colombia. However, seller financing is more common all the time and a good option.

Look forward to meeting you in Medellín in April.