The 2 Advantages Retirement In Mexico Offers Americans And Canadians

Top 2 Reasons This Country Is A #1 Plan B Choice

You might not think of Mexico as a top Plan B option… but you should.

Reason #1: It boasts one of the world’s easiest immigration programs

Travelers are granted long stays upon entry. If you don’t want to fuss with residency, you can get a six-month tourist entry by just driving over the border.

If part-year living… or maybe investing in and operating a vacation rental… is what you have in mind, then the six-month tourist entry can do the trick.

If your six-month visa runs out, you can simply drive to the border then get another six months when you cross back over… legally.

If you decide you do want to become a full-time resident of Mexico, the country makes both temporary and permanent residency status fast and easy to obtain.

As with many countries, you can use income to qualify, including a pension or Social Security.

But, unlike in most countries, you can also qualify for residency with savings, including a 401(k) or IRA balance.

Furthermore, your visa paperwork won’t require a notary seal, apostille, or translation, as it does most everywhere else. Mexico grants residency visas locally at your nearest consulate, using English-speaking agents…

Just bring your English pay stubs to the consulate, and you’ll be on your way.

No health checks or physical exam is required.

Neither is a background check… meaning you don’t have to worry about some indiscretion from your college days that could be a concern applying for residency elsewhere.

As I’ve mentioned, temporary residency is easy to qualify for with fast approvals… and permanent residency is available without a lengthy period of temporary residency.

Citizenship is available after five years of residency and in as little as two years if you qualify.

And Mexican tax residency is easy to avoid legally with no 180-day tax residency rule.

Here’s the second reason—in addition to easy residency—that makes Mexico a number-one Plan B option right now:

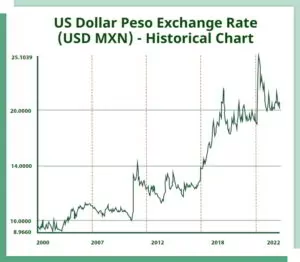

Reason #2: The dollar is near an all-time high

While inflation is eating into your capital in the United States, the dollar continues to enjoy historic highs against the Mexican peso.

The cost of living is low, and now you can compound that advantage with today’s “currency discount.”

Many foreigner-focused property markets sell in U.S. dollars, but rents and any real estate priced in pesos is at bona fide bargain levels.

Have a look at the chart below:

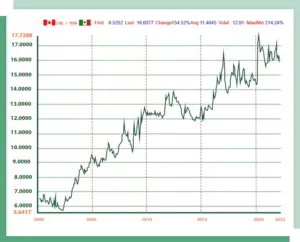

And Americans aren’t the only ones to benefit—Canadians likewise enjoy a historic advantage here: